Author Archives: Nick McCalmont-Woods

International SOS Confirms To Remain At Chiswick Park

Chiswick Park, the business campus located in West London, has announced that the world’s leading health and security services business, International SOS, has signed a reversionary lease in Building 4 to 2031. The 43,639 sq ft office is the company’s UK headquarters.

The lease renewal is testament to the culture and environment that Chiswick Park offers to its customers and demonstrates that leading businesses remain committed to securing the best office space for their staff to thrive in an environment that focuses on employee wellbeing and helps deliver corporate ESG agendas, despite the challenges posed by Covid-19.

Arnaud Vaissié, Co-founder, CEO & Chairman of International SOS, commented, ‘Our London office is critically important to us as our joint HQ and home to one of our 26 Assistance Centres. Since moving to the Chiswick Park site in 2012, we have been continually impressed with Enjoy-Work’s dedication to safety and sustainability. We are proud to make this long-term commitment to our people, our clients and to London.”

“We are delighted to continue to build on our long-term relationship with International SOS. This deal reinforces the appeal of a work environment that offers more than just an office, with plenty of outdoor space and onsite amenities available for workers. We are pleased that International SOS remains on our Campus to grow and develop further as a company “, said Matt Coulson, CEO Chiswick Park Enjoy-Work.

Chiswick Park covers 1.8 million sq ft of office space spread over 12 buildings. The Campus is home to some of the world’s leading companies including Pernod Ricard, IMG, Starbucks, Discovery and Danone.

The Park also houses over 45,000 sq ft of retail including a gym, restaurants, convenience stores and pop-up stores.

Onsite property management team, Enjoy-Work, is responsible for overseeing and performing the daily operations of the Campus as well as running a virtual programme of regular activities aiming to enhance the wellbeing and safety of its Guests.

Knight Frank acted for Chiswick Park and McCalmont-Woods Real Estate acted for International SOS.

About the International SOS Group of Companies

The International SOS Group of Companies is in the business of saving lives, protecting your global workforce from health and security threats. Wherever you are, we deliver customised health, security risk management and wellbeing solutions to fuel your growth and productivity. In the event of extreme weather, an epidemic or a security incident, we provide an immediate response providing peace of mind. Our innovative technology and medical and security expertise focus on prevention, offering real-time, actionable insights and on-the-ground quality delivery. We help protect your people, your organisation’s reputation, as well as support your compliance reporting needs. By partnering with us, organisations can fulfil their Duty of Care responsibilities, while empowering business resilience, continuity and sustainability.

Founded in 1985, the International SOS Group is trusted by 12,000 organisations, including the majority of the Fortune Global 500, as well as mid-size enterprises, governments, educational institutions and NGOs. 10,000 multicultural medical, security and logistics experts stand with you to provide support & assistance from over 1,000 locations in 85 countries, 24/7, 365 days.

To protect your workforce, we are at your fingertips: www.internationalsos.com

About Chiswick Park Enjoy-Work

Chiswick Park is a 1.8 million sq ft business campus located in West London, W4. Developed in 1999 and designed by Rogers Stirk Harbour + Partners, it is today made up of 12 buildings, bringing together over 10,000 people from 75 of some of the world’s leading companies such as Discovery, Paramount Pictures, IMG, Starbucks and Pernod Ricard. Chiswick Park is set in 33 acres of landscape garden featuring a lake and waterfall. It also houses over 45,000 sq ft of retail space including an on-site Virgin Active gym, restaurants, convenience stores and a variety of pop-up traders and street-food vendors.

Chiswick Park is entirely managed by property management company, Enjoy-Work, which provides a range of services, facilities and entertainment for its guests on the park. The Enjoy-Work philosophy aims at providing an environment where people take pleasure at working and are therefore more productive in their work. In addition to building management, landscaping and maintenance, Enjoy-Work proposes a programme of regular activities and concierge services dedicated to the guests. https://enjoy-work.com/

International SOS

Chiswick Park, W4

Health & security company

International SOS is the world’s leading health & security services company. More than 12,000 multi-cultural health security and logistics experts stand by to provide support and assistance from over 1,000 locations in 90 countries. The company takes around 4 million assistance calls every year and has close to two-thirds of the Fortune Global 500 companies as clients.

Background

McCalmont-Woods was tasked with devising and implementing a break option strategy for International SOS on its London office HQ (comprising circa 44,000 sq ft) situated at Chiswick Park, W4 in West London and considered by many to be London’s premier office business park location.

Over a period of 8-months leading up to the date for service of the tenant’s break notice, a comprehensive review of the central London office market was undertaken during the midst of the global pandemic. This involved the analysis of 70 properties and after careful review and the physical inspection of 15 buildings, a shortlist of potential relocation options was drawn up. Requests for proposal were issued to various landlords with detailed heads of terms negotiations conducted on a select number of (‘the go’) options. In parallel with the relocation exercise, the opportunity to restructure the tenant’s existing office leases (‘the stay option’) on Chiswick Park was explored in detail with Revantage Europe (a Blackstone company) advising the tenant’s existing landlord CIC, the Chinese sovereign wealth fund.

Outcome

The successful break option strategy devised by McCalmont-Woods resulted in International SOS remaining at Chiswick Park under restructured lease terms which produced circa £4 million savings for the business, reported to be “the most generous terms ever offered on a lease regear at Chiswick Park”.

Michael Whitlow, Human Resources Director, Assistance Business Line

“Thank you so much for delivering such an incredible outcome for the business. It has been a pleasure partnering with you on this critical project.”

Apex

London Office Rents In Decline As COVID Reality Bites

Prime rents unlikely to recover to pre-pandemic levels before 2022, says global membership body.

The abrupt decline in leasing activity in London’s office market has already translated into falling rents with the worst still to come, according to office specialists from the Society of Industrial & Office Realtors (SIOR). the leading global professional office and industrial real estate association.

A combination of stalled deals, increasing vacancy as tenants begin to offload suplus space and lease breaks has slowed leasing activity down to 1.2 million sq ft in Q2 2020, representing a 57% drop on the previous quarter, according to figures from DeVono Cresa.

Based on the same data from DeVono Cresa, this has already impacted rental levels with prime rents on Grade A space dipping by an average of 3% since Q1 2020. The biggest falls have been recorded in traditionally robust submarkets such as Mayfair (-8%) and Soho (-8%).

Paul Danks, Director at DeVono Cresa, and President-Elect of SIOR Europe, said: “As a result of the ongoing pandemic, we expect the lettings market l to remain subdued compared with historical levels mixed with increased appreciation for flexible office space. This will, in turn, lead to an increase in availability across central London. What we are seeing, and in a very short period of time, is a swing in the balance of power back towards the tenant.”

Though these figures are unsurprising, Nick McCalmont-Woods, CEO of McCalmont-Woods Real Estate, believes there is potentially worse news yet to come as the UK officially enters its first recession since the Global Financial Crisis (GFC).

“What we saw with the GFC of 2008/2009 was an initial softening of rents in the immediate aftermath of Leman Brothers’ downfall. Yet, as the economy contracted and the recession deepened, landlords were persuaded to offer far more competitive terms to attract a dwindling pool of occupiers”, he said.

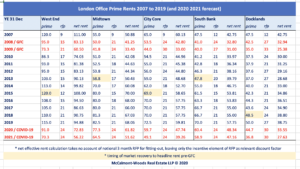

The analysis [see table below] from McCalmont-Woods Real Estate shows that, though London’s prime office rents experienced a decline of between 9% and 21% over the first twelve months of the GFC, it took another twelve months for the market to reach bottom with prime rents having fallen between 16% and 39% from their peak at the end of 2007.

“As occupiers adjust to the impact of COVID-19 on their businesses and scale back, delay or even shelve some office requirements altogether, we expect the pattern of rental decline from the GFC to repeat itself and, if anything, it may be exacerbated further in the event that significantly more tenant/occupier controlled space is released back on to the market as businesses adopt new working practices in the longer-term.

Consequently, there is likely to be considerable uncertainty in the months ahead with rising unemployment, dwindling demand for space and an expectation that rents will tumble across the office sector. On that basis, we are unlikely to see the true impact of COVID-19 on rental levels before Q4 2021/Q1 2022 and cannot anticipate prime rents returning to 2019 levels any time before 2022, and possibly much later, if history is to repeat itself”, adds McCalmont-Woods.

Paul Danks, added: “While it would be unwise to bet against the long-term resilience of a market like London, there can be little doubt that we are going through a major period of re-adjustment. As occupiers’ understanding of the new working world improves and landlords’ responses to it evolve, we will all have to learn to live with a little more uncertainty”.

About SIOR

The Society of Industrial and Office Realtors ® (SIOR) is the leading society for industrial and office real estate professionals. Individuals who earn their SIOR designation adhere to the highest levels of accountability and ethical standards. Only the industry’s top professionals qualify for the SIOR designation. Today, there are more than 3,400 SIOR members in 685 cities in 38 countries. www.sior.com

Apex Assigns Lease To Direct Line

Global financial services provider Apex Group Ltd, advised by McCalmont-Woods Real Estate, has assigned its lease on 8,100 sq ft surplus offices at 1 Minster Court, EC3 in the City of London to leading UK insurer Direct Line Group.

The successful lease disposal for the full 5-year term remaining generated significant cost savings of circa £3.25m (US $4m) for Apex despite the deal being delayed three months due to COVID-19.

The landmark City building featured as the headquarters of Cruella DeVil’s fashion house ‘House of DeVil’ in Disney’s 101 Dalmations (1996) although surprisingly, the movie didn’t feature in film buff Barry Norman’s 100 Greatest Films of All Time!

Apex Group Ltd., established in Bermuda in 2003, is a global financial services provider. With 45 offices worldwide and 4,000 employees, Apex delivers an extensive range of services to asset managers, capital markets, private clients and family offices.

1 Minster Court, EC3

Fund administrators

Apex Group Ltd., established in Bermuda in 2003, is a global financial services provider. With over 45 offices worldwide and 4000 employees, Apex delivers a broad range of solutions to asset managers, capital markets, private clients and family offices. Apex administers over $650 billion in assets globally. Sub-brands within the Apex Group include Throgmorton, LRI and European Depositary Bank.

Ipes was founded in 1998 specifically with Private Equity in mind and pioneered the Private Equity specialist approach to fund administration. Ipes is now part of Apex Group Ltd since 2018

Background

When, in 2015, leading provider of fund administration and outsourcing for European private equity Ipes wanted to grow its headcount and achieve property cost savings it enlisted McCalmont-Woods to help relocate its London office from Victoria in the West End to the City of London where rental values were lower. The resultant acquisition of 8,100 sq ft on a new 10-year lease at 1 Minster Court, EC3 produced immediate cost savings of £750,000 for the business and enabled Ipes to cap its liability for service charge for five years.

When three years later in 2018 Silverfleet Capital realised its investment in Ipes, new business owner Apex Group Ltd (backed by Genstar Capital) resolved to further improve the business’s operational performance by amalgamating all functions into a single office site whereupon McCalmont-Woods was tasked with disposing of the now surplus lease on the 9th floor at 1 Minster Court, EC3.

Outcome

The successful assignment in 2020 for the full 5-year term remaining under Apex’s lease, to leading UK insurer Direct Line Group, produced £3.25 million cost savings for Apex.

Mark Coppin, Operations Director, Ipes/Apex

“McCalmont-Woods’s flexible, approachable style and years of experience in its sector gave a great deal of confidence that we were getting the best deal available. Moving offices is a once in ten years project for us whereas McCalmont-Woods has been continually guiding clients through this process for as many years. Their pragmatism and knowledge were an essential part of ensuring everything happened smoothly and on budget.”